Budget vs Forecast – there’s a difference….

Most people use these terms interchangeably, however, there is a subtle difference. Every business should, each year prior to the start of the new fiscal year, create a budget.

Once approved, this budget is set in stone. It doesn’t change, and is not updated, it is what it is. Each month the company measures its success or failure based on that budget.

Don’t things change?

But life is not static; it is as Viktor Frankenstein once remarked “It’s alive!” Things change, the economy, the weather, the political landscape, disasters, a marketing campaign that goes viral. All these elements make that best guess budget out of date.

But life is not static; it is as Viktor Frankenstein once remarked “It’s alive!” Things change, the economy, the weather, the political landscape, disasters, a marketing campaign that goes viral. All these elements make that best guess budget out of date.

So, we re-budget the budget. However, we call it a forecast. And if you do that re-budgeting multiple times, you are re-forecasting.

Do you forecast the entire budget?

This is the most misunderstood aspect. The answer is no. You re-forecast the data points where added information is available or where you feel that the environment in the future will materially change your line items in your budget.

Thus, if suddenly you get a tremendous opportunity to place an advertisement in a strategic publication, and that opportunity was not included in the budget, then you re-forecast advertising.

If you feel sales will then take off by an additional 20% the month after the ad appears, you re-forecast the sales figures for as long as feel that increase will be sustained.

Budgeting is a long and exhaustive process. Forecasting is much easier, because many expense items won’t change or if they do, they are already built into the budget. Sales are the single largest item that needs to be re-forecasted.

The big question

The question is how often? You could forecast/re-forecast daily. But that seems to be too often, or is it?

The question is how often? You could forecast/re-forecast daily. But that seems to be too often, or is it?

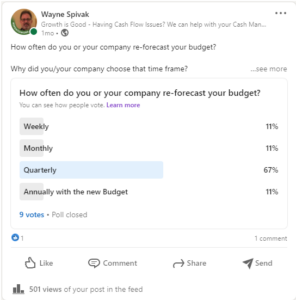

We asked on LinkedIn that exact question. “How often do you or your company re-forecast your budget?”

The poll ran for a week and closed with 501 views and a paltry 9 votes. Regardless, we can gleam valuable information.

One-third of the voters each picked Weekly, Monthly and Annually. Two-thirds (66%) picked Quarterly.

Interesting. The person who picked weekly; what business could they be in? What business changes dramatically week to week? Is the cost of re-forecast worth the value of the data? I wonder.

Annually with the new budget? That is a person that doesn’t understand or appreciate the need to accurately (or as accurately as possible) to see the trajectory of the company’s sales and expenses. What is even more important, the budget/forecast is a crucial element in cash flow management.

This leaves the person who thought Monthly, and the six people who chose Quarterly. Both, depending on the business dynamics, could be correct. Stable businesses with stable sales and expenses may only receive help from a once in 3-month update, others need a monthly basis.

Cash Flow Analysis

As mentioned, the budget/forecast is part of the company’s cash flow analysis. If cash flow is incredibly positive and runway is plentiful, then a longer period between re-forecasts may be called for. However, if money is tight, you really need a good understanding of what your sales may be. Any added future expenditures not originally contemplated need to be re-thought. Monitoring your sales and expenses closely is the only way to know if you’ll have enough cash or need to find alternative cash investment (debt or equity).

What’s your feeling on the matter?