In today’s cut-throat e-comm marketplace, give-a-ways run amok. Free shipping, discounts from 5% to 30%, cost-free gift wrapping, overnight shipping, rush orders. You name it, companies are competing with any and every extra service they can think of to win your order.

Stop the insanity

But all these give-a-ways cut into the gross profit margin. And depending on the price-point that your average item and average order falls into, you may not be making enough money to survive.

Think about some of your costs, besides the cost of goods sold (COGS).

Shipping

Shipping, depending on your product base, can cost at least a $2 – $3 dollars to $10-$30 per package (or more, think of an uninterruptable power supply, those heavy suckers you buy to protect your electronics). Don’t forget to add the cost of shipping supplies….

Discounts

Did you calculate your average discount? What about markdowns? What does the average reduction to the sales price do to your IMU or initial markup? Can you make money at the MMU Maintained markup percentage?

Gift wrapping

Is that free as well? That has an added cost.

Commissions

Are you paying sales commissions? You would need to add that into the calculation as well (for both IMU and MMU).

Formulas

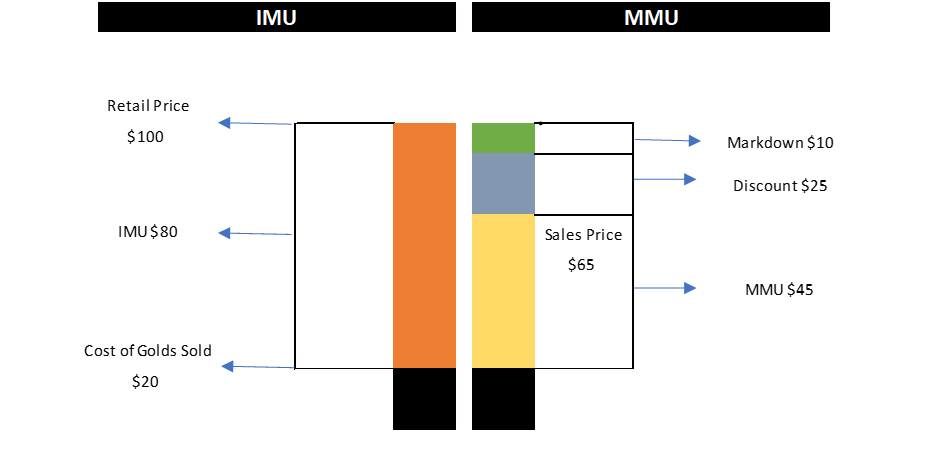

A quick recap to calculate IMU & MMU per the standard textbook.

IMU

Initial Markup = Retail Price – Cost

Initial Markup % = [IMU/Retail Price] x 100

MMU

Maintained Markup = Sales Price – Cost – Markdowns -Discounts

Maintained Markup % = MMU/ Sales Price x 100

Graphically it looks like…

IMU = ($100-$20) = $80

IMU% = $80/$100 = 80%

MMU = (($100-$25-$10)-$20) = $45

MMU% $45/$65 = 69.23%

Between markdowns and discounts, you are giving away $35 of gross profit. At $45 available gross profit, if you give free shipping and shipping costs $15 (including supplies), your contribution margin is now $30.

A Contribution margin is the amount of money available to pay all other costs (overhead). This includes the warehouse, the office, staff, insurance, etc. This is a simplification of the break-even calculation. It can tell you how many units you need to sell:

Units = other costs/contribution margin (we’ll say other costs to run the business is $1500)

Units = $1500/$30 = 50

Thus, you need to sell 50 units to break even.

If you raise the Revenue by either raising the MMU or lower reductions, your contribution margin will increase. If your contribution margin goes up or you lower your other costs, your break-even number (and how many units need to meet that point) will decrease.

Findings

We’ve found that clients’ price on what they think the market will bear and their position in the market. Then they try to match the give-a-ways. The problem with this thinking is if they are the small guy, their costs are always higher. They may not be buying their product at the best price, given they can’t meet higher economic order quantities. Their shipping costs will be greater, because they can’t negotiate based on a higher volume of shipments. The list can go on.

These clients are failing to use their value propositions to entice customers to pay more for their services/products.

You can make more money and sell less items depending on costs and profit margins. As a business you should be running these models to find the optimum retail and average sales prices.

SBA * Consulting can help.