Why do I need to do a Cash Flow Statement when I have a Statement of Cash Flows?

This is a common question we at SBA * Consulting often gets. This is also one of the greatest misunderstandings of what accounting is and isn’t. What is the role of the CPA at a public accounting firm? What is the role of a Chief Financial Officer? And they all nicely dovetail into this overarching question.

Accounting

Accounting in its purest view is an historical view of what has happened. Invoices, bills, depreciation, Balance Sheets, Income Statements. They all show you what transpired. When you get audited, by either the CPA firm or by an insurance company, bank, or government, they all are looking at what has happened in the past.

Let us not belittle how important the past is. The past gives you receivables, payables and hopefully profit. While profit is today (historical), receivables and payables are a tomorrow item. We’ll get back to this.

The CFO

The CFO also deals with historical data. It is from this data that the creation of KPI’s happens. Those KPI’s track what has happened, trends, changes, and results of prior campaigns. The CFO is the point person to model the future.

What happens if we try this campaign? What is the result? How does it impact revenues, expenses, receivables, payables, EBITDA, investors, and creditors? Will there be and when will there be a return on investment? Is that campaign, project, hire sustainable (from a cash perspective)?

These are just some of the CFO’s roles, there are many more. But one of the overriding roles is cash management. For without cash, the company goes into default and ultimately bankruptcy.

Statement of Cash Flows vs Cash Flow Statement

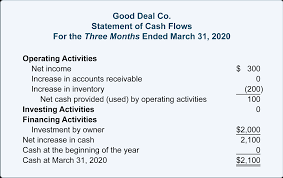

Believe it or not, these are two separate and distinct reports. The Statement of Cash Flows is historical, and part of the stand 3-part financial statements normally produced (with balance sheet and income statement).

Believe it or not, these are two separate and distinct reports. The Statement of Cash Flows is historical, and part of the stand 3-part financial statements normally produced (with balance sheet and income statement).

The Statement of Cash Flows shows where your cash came from and where you spent your cash. At the end of the statement, it proves that beginning cash plus/minus net cash received/spent is equal to your ending cash.

An import report to understand what has happened and bankers and investors poor over the report.

Cash Flow Statement

This is a forward-looking report that uses historical data, and budgets to make assumptions of how much cash you will have on a given day, month, quarter, year. It will provide you with the ability to see what your runway (how many days of cash you have) is, and when you will need to find financing.

Modeling Cash Flows will assist you to see the effects of increasing sale prices without corresponding cost of goods sold (by modifying the budget). You run a different model that may say expenses should be 15% over the previous period last year. You can model almost anything.

Which one is correct? Well, that comes down to how well you project (assumptions) your sales and expenses.

Which report is necessary?

Since most accounting systems create the Statement of Cash Flows many seem to think this report is the answer to necessary. Wrong. You need a Cash Flow Statement, and you need to do the function (the CFO’s role in most companies) on at least a weekly basis if not more.

Every day the world changes, the assumptions budgets are based on change. If you never reforecast, then your runway underlying assumptions will be wrong.

Surprises about lack of cash are not where you want to be or for it to happen.

Why not contact SBA * Consulting to advise you on your Cash Flow Management!