The other day a salesperson with one of the new expense programs that come with those virtual expense cards called.

These programs seem to be all the rage, as in the last two years many new and some old companies entered this marketspace.

I’m being told by salespeople and after reviewing numerous websites that there are all sorts of checks and balances on the use of the card.

Card Claims

Some of the card vendors claim the ability to block or restrict spending to a specific vendor on an individual card. (Imagine you have 50 vendors and use this feature, you’d need 50 numbers: not realistic, but definitely a possibility and in my view a nightmare…).

Some virtual cards can also restrict amount (credit limit), but also time (during work hours, not after) or category (think AMEX classifications, which are not always correct).

The problem is that with all these cards, they are for the most part reactive, not proactive.

Ah, you say, didn’t I just say they can limit by category and time of day, or even vendor! Yes, I did, but here there is a will, there is a way. The more you develop the ACL (access control list) of who can and can’t buy what, where and when, the more time is spent managing this system.

And we all know of the “exception” rule. For every rule there are an untold number of exemptions or exceptions. Someone who doesn’t have travel on their card needs to travel. Someone who never buys from vendor “X“, now needs to buy. Someone’s card needs this or that ability, which is currently doesn’t have, or the buy is over their credit limit for that category/vendor.

What if?

Even with a well developed and implemented control schema, you have this scenario:

An employee with a virtual card buys flight tickets [or any category they are allowed to purchase]. It isn’t for the company; it is for their vacation [or fill in the purpose]. They didn’t request permission.

The purchase is at best an error or worse fraud. None of these systems will stop this type of purchase, unless they have such a low credit limit.

That makes the system reactive, not initiative-taking or proactive.

Corporate Charge Cards

What do you do now when you find errant charges on corporate cards? You disallow them and if the card is paid by the company, you request the employee reimburse the company. If the corporate card is paid by the employee, then they need to pay for the card.

But most corporate cards still have a corporate guarantee on the card in general if an employee does not pay.

Alternative:

If employees are forced to use their personal card and seek reimbursement, now that’s proactive.

I’ll list the caveats to the argument that the employee may not have a credit card, or not enough credit, etc. These caveats also apply to the argument that employees should be given the tools to do their job by the company.

No credit card/limited credit on card

Solutions include:

• Large purchases: the company can make on behalf of the employee. If they don’t have a card, have them get a card and start developing credit.

• Supply outlets to teach your employees budgeting and credit counseling.

• Weekly expense reporting and payment means the employee can either pay the card early or the company can pay the credit card company directly.

Employers should give them the tools to do their job

This concept isn’t very valid these days, especially with remote work. Companies are not supplying computers for their employees. They aren’t paying for internet access, routers, printers, and other tools that would normally be found at the office. On the other hand, employees may have taken home corporate equipment. Many tradespeople are required to buy their own tools (many companies help in this process).

Well, if the company encourages employee good stewardship of their personal finances, then the company has also given that employee better tools in not only to do their job but live their life.

Poll

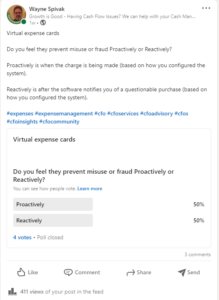

We ran two polls on linked in. The first asked the question “Do you feel they prevent misuse or fraud Proactively or Reactively?” Some 411 people read the poll, but participation was practically nil. Nevertheless, the results were 50/50.

We ran two polls on linked in. The first asked the question “Do you feel they prevent misuse or fraud Proactively or Reactively?” Some 411 people read the poll, but participation was practically nil. Nevertheless, the results were 50/50.

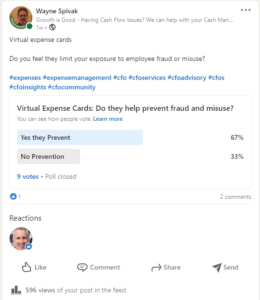

The other question was “Do they help prevent fraud and misuse?” 596 people look at this poll (LinkedIn polls in general react so strangely. In this instance, the polls were posted within minutes of each other, but there is a significant difference in the number of views.) Participation was better (but that’s not saying much) with two-thirds feeling they prevent fraud.

people look at this poll (LinkedIn polls in general react so strangely. In this instance, the polls were posted within minutes of each other, but there is a significant difference in the number of views.) Participation was better (but that’s not saying much) with two-thirds feeling they prevent fraud.

What’s your opine?