The concept

When I taught accounting in the late 90’s/early 2000’s at the City University of New York, I spoke about the principle of a Going Concern. The Going Concern principle was one of the seven accounting principles which define the needs and requirements of accounting.

The definition was as simple as it was crucial; a company what an entity that went on ad infinitum.

Reality was always different. Some companies succeeded, many didn’t. Few, comparatively speaking, were joint ventures whose creation was of a limited duration, but most businesses were started to last forever.

There were great examples of long-standing firms to which we can look to for pristine examples of the Going Concern Principle: Caswell-Massey (founded 1752), The Hartford Courant (founded 1764), Brooks Brothers (founded 1818), Colgate (founded 1806) and Macy’s (founded 1843) are just a few.

According to an article in the Business News Daily, updated Jan 27, 2022 stated, “Only 66% of businesses make it to the two-year mark, and about half survive beyond five years. ”

Has that concept changed?

Today if you read business-oriented media that ‘forever” concept has changed to a window of four to six years. A far cry from years ago. Who or what is to blame for this diminution of time?

Private Equity/Venture Capital is mostly responsible for changing the lifespan of a business. Four to six years is the window in which they hold their portfolio companies. Upon sale, there is no expectation that the company will continue, as these portfolio companies are sold and merge into their new entities; have a mission change or even a name change.

The Question

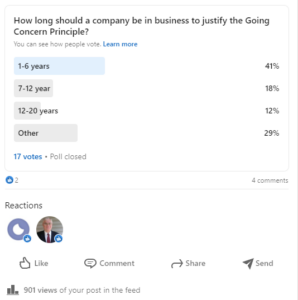

So, I asked my LinkedIn audience. 901 people viewed the poll, with seventeen voting. The question was when, in years, has the concept of Going Concern been fulfilled. The majority of respondents stated 1-6 years in business.

Barrett Peterson, CPA made an interesting observation.

“It is financial capacity and operating results that drive the evaluation, not age.

What is your definition in years that justifies the Going Concern Principle? Going concern is the default presumption unless there are negative indicators of possible inability to survive for 12 months after the financials are issued…usually 13-25 months. Available cash is the basic evaluation determinant. Cash comes from profitable operation, net from working capital changes (a one-time source generally), and external capital, as loans or equity. Length of history is not a factor, except as a possible indicator of realistic expectations of profitable operations. Going concern does not mean “forever,” just a shorter look forward. Economic drivers can change “going” to failing” quickly in some cases.”

So, what do you think the new definition of the Going Concern should be?